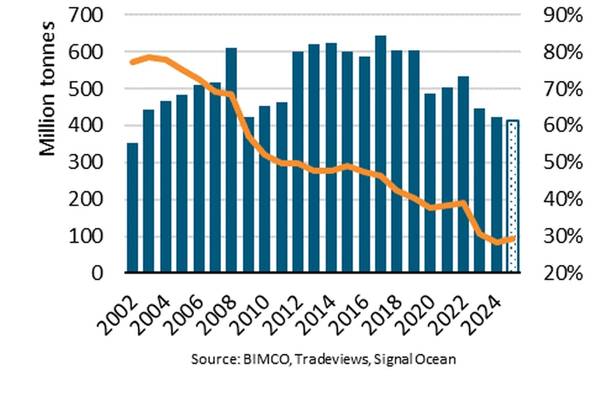

Coal Shipments Plummet to 23 Year Low

Nov 25, 2025

Chart courtesy BIMCO

“We estimate that coal shipments to advanced economies will fall 2% y/y in 2025, reaching a 23-year low. This will be the third consecutive annual drop although the pace of decline has slowed compared to previous years. The contraction is primarily driven by weaker coking coal demand due to reduced steel production,” says Filipe Gouveia, Shipping Analysis Manager at BIMCO.

Between January and October, global steel production fell 2.1% y/y according to the World Steel Association. Advanced economies which rely on coking coal imports showed a pronounced weakening with production falling 3.4% y/y in the EU, 4.1% y/y in Japan and 3.6% y/y in South Korea. Consequently, coking coal shipments to advanced economies fell 10% y/y.

Between 2022 and 2024, thermal coal shipments to these economies fell 30% but surprisingly, they have risen 1% y/y so far in 2025, driven by stronger shipments to the EU during the start of the year. Electricity demand rose in Germany and the Netherlands, while electricity generation from wind and hydro power fell. Shipments to Japan and Korea remained stable as higher electricity demand from AI data centres and semiconductors manufacturing offset growing electricity generation from renewable sources.

“Advanced economies are expected to be the destination of 29% of coal shipments in 2025, a sharp decline from 77% 23 years ago. Despite this, they will still represent about 7% of global dry bulk cargoes. Consequently, this year’s drop in shipments is expected to have negatively impacted the market, especially the panamax and capesize segments,” says Gouveia.

So far in 2025, 57% of these cargoes have been transported by panamax ships and another 30% by capesize ships. Price competition from the panamax segment appears to have increased, raising their share of cargoes by three percentage points compared to 2024.

Next year, advanced economies’ coking coal import demand could recover, especially in Europe. The World Steel Association expects Europe’s steel demand to rise 3% due to an increase in infrastructure and defence spending. This could support steel production in Europe, especially if the EU raises tariffs on steel and cuts tariff free import quotas. However, in the medium term we expect coking coal demand to grow slower than steel production. Recycled steel production is expected to gradually increase, and this process doesn’t require coking coal.

“Thermal coal import demand is projected to continue decreasing over the coming years, negatively impacting ship demand. Between 2025 and 2030, renewable energy capacity is forecast to grow by 64% in Europe, 30% in Japan and 49% in South Korea, according to the International Energy Agency,” says Gouveia.

Ports

Cargo

Green Ports

Coal Carriers